TAOS is a Bittensor subnet with netuid number 79. Its participants are incentivized to produce meaningful AI contributions using carefully risk-managed trading algorithms in a large-scale agent-based simulation of automated (intraday) trading strategies.

One of the more unique aspects of this decentralized simulation framework is that its participants can take advantage of “deep” limit-order-book (dLOB) data, and with some limitations to be relaxed later on, develop even “deeply intelligent” high-frequency trading (dHFT) type faster strategies.

More specifically, the challenge is to create reward-risk maximizing – likely AI-driven – trading algorithms that would consistently outperform the other agents’ logic. The races operate 24/7 like real crypto or FX markets, many race-simulations running in parallel to maximize the statistical significance of the runs’ average.

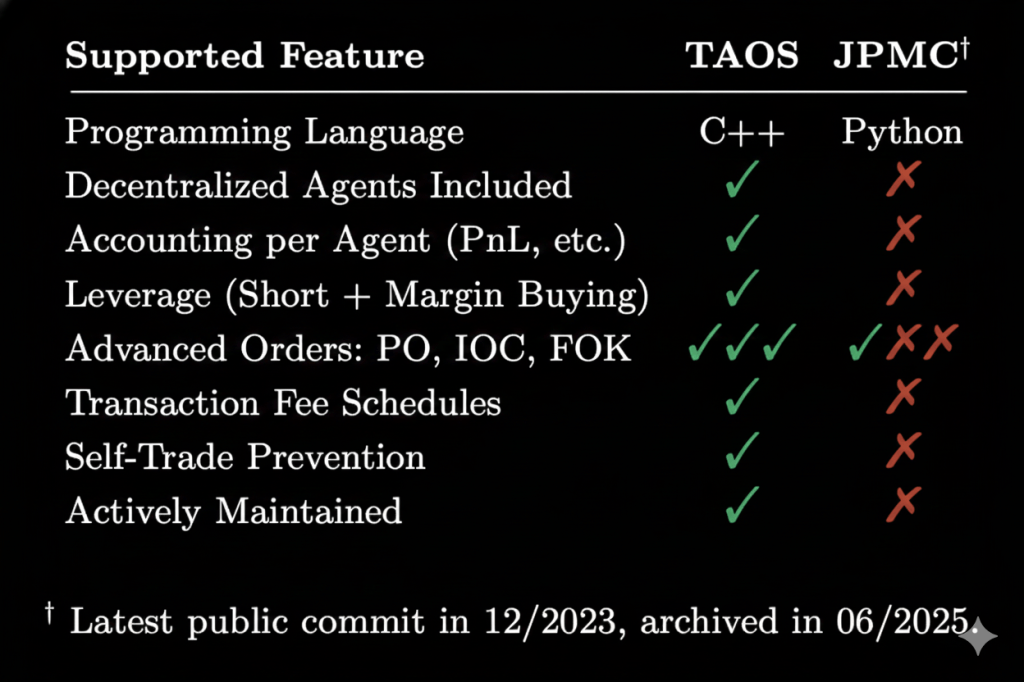

For more information about the theoretical underpinnings of the framework and its potential real-world applications, with current limitations, see our white paper. For a quick comparison to an existing framework supported by JP Morgan Chase, see below, giving an idea of the extensive features built into the decentralized TAOS framework.

taos (/ˈtɑos/) : To make things out of metal by heating it until it is soft and then bending and hitting it with a hammer to create the right shape.